Assets Under Management *

Properties

Apartments Under Management

Cities

(1) Includes Lankin Apartment REIT non-controlling interest in associated joint venture.

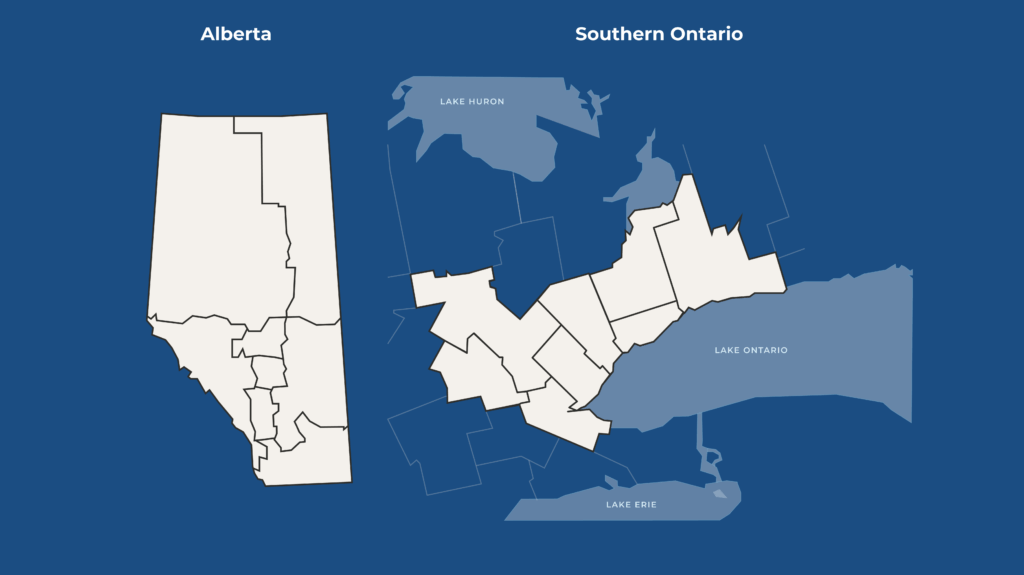

Lankin Apartment REIT is a real estate investment trust designed to provide investors with targeted monthly cash distributions and long-term capital appreciation. The fund targets newly constructed & stabilized properties within strategic rental markets across Canada. The strategy focuses on long-term ownership, aiming to generate steady cash flow through active management in high-growth markets.

Explore the funds nationwide portfolio, showcasing Lankin Apartment REITs strategically located multi-family properties across Canada.

8

Properties

4

Cities

This vibrant 219-unit community in Brampton features spacious suites, premium amenities—including a pool—and easy access to transit, shopping, and everything you need close to home.

Located in a prime Brampton neighbourhood, this 339-unit high-rise community features spacious, thoughtfully designed suites and modern upgrades throughout.

This portfolio offers 242 rental units across four well-maintained Brampton properties, providing residents with comfortable living, convenient amenities, and easy access to schools, parks, and transit.

This 118-unit multi-residential property is located in the heart of Mississauga, offering residents exceptional connectivity and convenience.

This 140-suite multi-residential property is strategically located in Mississauga, Ontario, within a well-established residential community.

This 110-unit community in Newmarket, Ontario offers families comfortable living with close proximity to top-rated schools, lush green spaces, and convenient access to transit.

This brand-new 177-unit apartment community in Sherwood Park, Alberta features modern suites, high-end finishes, and beautiful amenities designed for comfortable, contemporary living.

A newly built, modern 89-suite multi-residential property in Edmonton’s Inglewood neighbourhood, offering residents convenient access to local amenities, transit, and a vibrant community atmosphere.

This vibrant 219-unit community in Brampton features spacious suites, premium amenities—including a pool—and easy access to transit, shopping, and everything you need close to home.

Situated in a prime Brampton neighbourhood, this 339-unit high-rise community features spacious, thoughtfully designed suites and modern upgrades throughout.

This portfolio includes 242 rental units across four well-maintained properties in Brampton, offering residents comfortable living, convenient amenities, and access to schools, parks, and transit.

This 110-unit community in Newmarket, Ontario offers families comfortable living with close proximity to top-rated schools, lush green spaces, and convenient access to transit.

This 140-suite multi-residential property is strategically located in Mississauga, Ontario, within a well-established residential community.

This 118-unit multi-residential property is located in the heart of Mississauga, offering residents exceptional connectivity and convenience.

This brand-new 177-unit apartment community in Sherwood Park, Alberta features modern suites, high-end finishes, and beautiful amenities designed for comfortable, contemporary living.

A newly built, modern 89-suite multi-residential property in Edmonton’s Inglewood neighbourhood, offering residents convenient access to local amenities, transit, and a vibrant community atmosphere.

Investing in stabilized multi-family residential properties across Canada offers investors targeted, consistent monthly distributions and long-term equity growth.

Multi-family real estate investments are typically supported by rental income, which may provide a source of cash distributions and has historically demonstrated relative stability across market cycles.

Private real estate is often considered a long-term asset class with valuation and liquidity characteristics that differ from publicly traded securities. This asset class may support capital preservation and return objectives across varying economic conditions.

Historically, real estate values and rental income have tended to adjust over time in inflationary environments, which may support purchasing power while continuing to meet demand for quality housing

Unlike stocks or bonds, real estate is a physical asset with inherent worth that may offer security and control over investment performance through active asset management.

Ongoing housing demand in Canada has historically supported occupancy in well-managed multifamily properties, which may contribute to long-term value creation while continuing to meet tenant housing needs.

Multi-residential investments support local economies and may improve housing availability and contribute to vibrant, thriving communities.

You will have a short 30 minute call with an Investment Consultant.

You will discuss general fund details, qualification criteria, minimum investment values, and you’ll get all your questions answered.

Embark on your investment journey with Lankin Investments today and unlock the potential for long-term financial success. Our expert team is here to guide you.

Disclaimer: Please consult the confidential offering memorandum relating to particular securities offering. Past performance is not an indicator of future performance.