14-18% Targeted Annual Returns

Stabilize & Diversify your Portfolio With Hassle-Free Real Estate Investing

With as little as $5k, you can tap into reliable monthly cash-flow-without owning any property yourself

Is Your Portfolio Falling Short?

Discover How Lankin Investments Secures Your Financial Future with Less Stress

Are you concerned about the performance of your current investment portfolio? If

you find yourself constantly worrying whether your investments will sustain your

desired retirement lifestyle, you’re not alone. Many investors share your

frustrations with the volatility and unpredictability of the public markets. It’s all too

common to feel stuck with a financial advisor or plan that doesn’t seem to

understand your needs or align with your goals. If you’re looking for a way to

diversify your investments and find a more stable path forward…

There Is A Better Way

What Is The Better Way?

With Lankin Investments, you can achieve attractive annualized returns ranging from 14% to 18%. Enjoy consistent cash flow with 8% annual returns paid out monthly, directly enhancing your regular income. Our partnership structure is designed for tax efficiency, offering significant personal and corporate tax advantages to optimize your overall returns.

Moreover, our flexible investment vehicles, including options for Cash, RRSP, TFSA, LIRA, and RRIF, ensure that your investment strategy is perfectly aligned with your financial goals and retirement plans. This comprehensive approach provides a stable, rewarding investment path tailored to your needs.

Moreover, our flexible investment vehicles, including options for Cash, RRSP, TFSA, LIRA, and RRIF, ensure that your investment strategy is perfectly aligned with your financial goals and retirement plans. This comprehensive approach provides a stable, rewarding investment path tailored to your needs.

Investor benefits

Attractive Returns

Targeted annualized

returns of 14%-18%.

Cash Distributions

Enjoy 8% annual

cashflow paid monthly

Tax Efficiency

Enjoy personal or corporate

tax advantages through our

partnership structure,

designed to optimize your

investment returns.

Flexible

Investment Vehicles

Our diverse options

accommodate various

investment strategies,

including Cash, RRSP, TFSA,

LIRA, and RRIF, ensuring

your investment aligns with

your financial goals and

retirement plans.

Ease In Starting

Begin with as little

as $5000

Discover An Alternative Path To Porfolio Success

Our licensed dealing representatives are standing by to answer any and all inquiries you may have.

Book your call today to learn how you can ensure your portfolio is working as hard as you do.

Book your call today to learn how you can ensure your portfolio is working as hard as you do.

Here's What Happens

After You Book A Call:

STEP ONE

You’ll have a short 15-30 min initial call with one of our licensed Dealer Representatives to discuss general fund details, qualifications, minimum investment and you’ll get all your questions answered. If appropriate, a second call will be booked.

You’ll have a short 15-30 min initial call with one of our licensed Dealer Representatives to discuss general fund details, qualifications, minimum investment and you’ll get all your questions answered. If appropriate, a second call will be booked.

STEP TWO

Based on the details of the first call, the second call is where you’ll receive the full fund presentation, where specific details are discussed such as initial investment amount, timelines.

Based on the details of the first call, the second call is where you’ll receive the full fund presentation, where specific details are discussed such as initial investment amount, timelines.

STEP THREE

You’ll have a short 15-30 min initial call with one of our licensed Dealer Representatives to discuss general fund details, qualifications, minimum investment and you’ll get all your questions answered. If appropriate, a second call will be booked.

You’ll have a short 15-30 min initial call with one of our licensed Dealer Representatives to discuss general fund details, qualifications, minimum investment and you’ll get all your questions answered. If appropriate, a second call will be booked.

STEP ONE

You’ll have a short 15-30 min initial call with one of our licensed Dealer Representatives to discuss general fund details, qualifications, minimum investment and you’ll get all your questions answered. If appropriate, a second call will be booked.

You’ll have a short 15-30 min initial call with one of our licensed Dealer Representatives to discuss general fund details, qualifications, minimum investment and you’ll get all your questions answered. If appropriate, a second call will be booked.

STEP TWO

Based on the details of the first call, the second call is where you’ll receive the full fund presentation, where specific details are discussed such as initial investment amount, timelines.

STEP THREE

You’ll have a short 15-30 min initial call with one of our licensed Dealer Representatives to discuss general fund details, qualifications, minimum investment and you’ll get all your questions answered. If appropriate, a second call will be booked.

What's A REIT?

A residential REIT (Real Estate Investment Trust) specializes in owning, operating, or financing residential properties that generate rental income. These properties can include apartment complexes, student housing, manufactured homes, and single-family homes. Like all REITs, residential REITs offer investors a way to participate in the real estate market without the need to directly buy or manage property.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

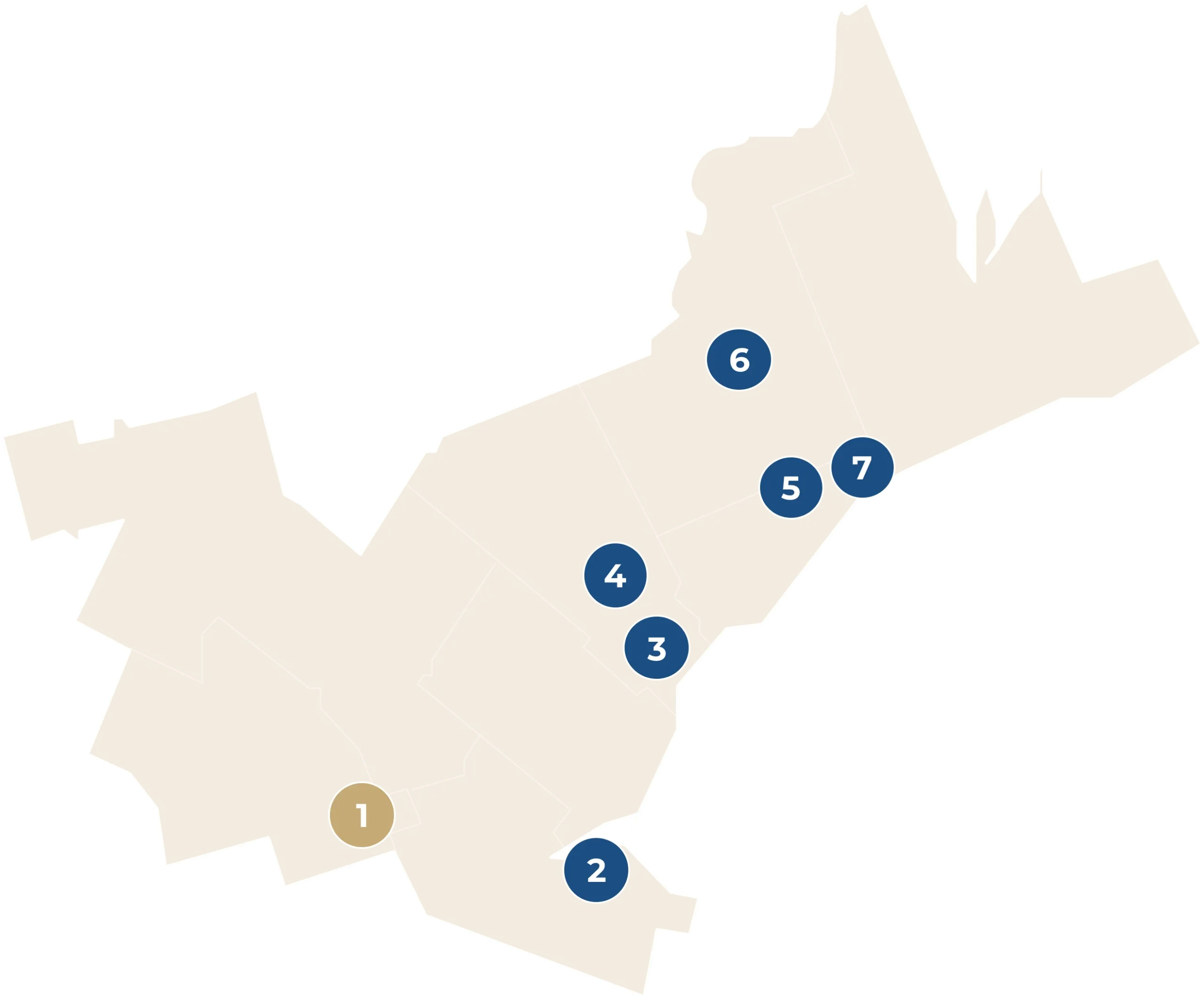

Lankin Investments

Multi-Residential Fund

Explore an exceptional investment opportunity with a minimum entry of just $5,000. Our portfolio spans 52 properties across 8 thriving communities, designed to deliver robust financial returns.

We target annual returns of 14-18% and offer an attractive 8% annual cash flow, distributed monthly to our investors. This strategic investment promises not only steady income but also significant growth potential, making it an ideal choice for those looking to enhance their financial portfolio, and escape the volatility of the public markets.

We target annual returns of 14-18% and offer an attractive 8% annual cash flow, distributed monthly to our investors. This strategic investment promises not only steady income but also significant growth potential, making it an ideal choice for those looking to enhance their financial portfolio, and escape the volatility of the public markets.

Cambridge

55 Woolley Street

The Grand River is very close by providing scenic views and parks. Near to the...

Waverley Financial

We’ve Partnered With

One Of Canada’s Best

Investment Dealers

Waverley diligently scans the Canadian market to identify investment opportunities that offer very high risk-adjusted returns, meaning we strive to maximize returns for our clients at controlled levels of risk, often reducing the risk where possible. A cornerstone of our investment strategy is the protection of principal, which we hold as paramount. All investments are secured by real assets, ensuring robust downside protection. Many of our opportunities also provide substantial cash flow, either monthly or quarterly, contributing to a steady income stream. Additionally, our selections are characterized by low volatility, with little to no correlation to the public markets, thus providing a stable investment environment.

How You Can Be On The Right Side Of History

Since the first World War, there have been 3 major dips in the S & P 500, followed by prolonged periods of recovery. Many economist feel that due to the current economic climate of increased inflation, we are experiencing the 4th major dip at the moment.

If history tells us anything, it is that like the dips previously, investors who are patient and forward-thinking can position themselves for success by either waiting out until the markets fully recover, or allocating some or all of their assets into alternative investment types for less volatility.

If history tells us anything, it is that like the dips previously, investors who are patient and forward-thinking can position themselves for success by either waiting out until the markets fully recover, or allocating some or all of their assets into alternative investment types for less volatility.

INVESTMENT

$5,000.00

$5,000.00

For Younger Investors Just Getting Started:

From an investing standpoint, youth and time go hand in hand. Your youth provides you with the time to properly set up your financial life and be miles ahead of your peers. If you're just getting started, we can help you start on the right path.

From an investing standpoint, youth and time go hand in hand. Your youth provides you with the time to properly set up your financial life and be miles ahead of your peers. If you're just getting started, we can help you start on the right path.

INVESTMENT

$5,000.00

$5,000.00

For Younger Investors Just Getting Started:

From an investing standpoint, youth and time go hand in hand. Your youth provides you with the time to properly set up your financial life and be miles ahead of your peers. If you're just getting started, we can help you start on the right path.

From an investing standpoint, youth and time go hand in hand. Your youth provides you with the time to properly set up your financial life and be miles ahead of your peers. If you're just getting started, we can help you start on the right path.

Who Can Benefit The Most

This investment opportunity is open to accredited investors. If you are unsure as to whether you qualify or not, book a call with one of our licensed dealing representatives to discover whether you qualify for this incredible opportunity. If you don’t, our dealer representatives can guide towards other alternative investments you may indeed qualify for.

Frequently Asked Questions

Still have questions? Book a call with one of our licensed dealing representatives today. They’ll provide you with expert guidance, tailored advice, and help you navigate the best opportunities for your financial goals.

Private market investments offer higher risk-adjusted returns, protection of principal investment, low volatility, and opportunities for diversification. These investments are often backed by hard assets like real estate, providing more stability and security compared to public market investments.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Toggle Content

Still have questions? Book a call with one of our licensed dealing representatives today. They’ll provide you with expert guidance, tailored advice, and help you navigate the best opportunities for your financial goals.

Frequently Asked Questions

Private market investments offer higher risk-adjusted returns, protection of principal investment, low volatility, and opportunities for diversification. These investments are often backed by hard assets like real estate, providing more stability and security compared to public market investments.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Toggle Content

Copyright © Lankin, 2024 – Powered by Uncomn Projects